|

| Name: _________________________ | Period: ___________________ |

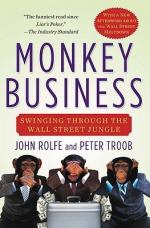

This quiz consists of 5 multiple choice and 5 short answer questions through The Holiday Party.

Multiple Choice Questions

1. What happened if a company was overvalued by an investment banker?

(a) The market will show the company is overvalued.

(b) The bank will try to keep the secret.

(c) The SEC got involved.

(d) The market will hide the true nature of the company.

2. How are the workers of the copy center treated?

(a)

(b) The associates treat them like dirt.

(c) Like kings and queens.

(d) Not very well.

3. Who acts extremely rude and perverse on a social night out?

(a) Bubbles, an annoying VP.

(b) Ferrano, a permanent associate.

(c) Gator, a sharp tongued managing director.

(d) Smith, an analyst.

4. What investment bank did Troob secure a job with?

(a) DLJ.

(b) Anz Investment Bank.

(c) Lehman Brothers.

(d) Barclays Capital.

5. What was clear about Troob and Rolfe's choice of career?

(a) They will work there for many years.

(b) They will be extremely rich.

(c) They won't be happy.

(d) They should have gone into another line of work.

Short Answer Questions

1. What did most of Bubble pitch books require?

2. Upon accepting the offer to DLJ, what were both Troob and Rolfe given?

3. Although vice presidents make associates difficult lives, associates cooperate because the vice presidents _______.

4. In the investment banking world, what were comps?

5. If a deal is brokered between a managing director and a client, what did this mean for associates and analysts?

|

This section contains 295 words (approx. 1 page at 300 words per page) |

|